Highest Return Mutual Fund in Last 10 Years: What Every…

Welcome to Master Fin Investments

Plan. Invest. Grow. With Certified Financial Experts

We are here to help you achieve your financial goals through tailored mutual fund and insurance solutions. Connect with best financial advisor in Ahmedabad & India

500+ Happy Investors

About Master Fin Investments

Trusted Mutual Fund Distributor and Insurance Advisor

We at Master Fin Investments, top financial advisor in ahmedabad we believe in empowering individuals and families to achieve financial stability and security. Since our inception, we have been dedicated to providing personalized financial solutions that align with your goals and aspirations.

With our expertise in mutual funds distribution and insurance advisory, we focus on offering transparent, reliable, and efficient services to help you make informed financial decisions. Our approach is rooted in trust, simplicity, and a commitment to your long-term success.

Whether you’re looking to plan for your future, secure your family’s well-being, or grow your wealth, we are here to guide you every step of the way.

Start Your Mutual Fund Journey Today !.

One SIP for all your needs.

Life goals like,

🏆 Child's College Education

30.00 L

🎯 Retirement

2.00 Cr

Can be achieved with one SIP of

₹40,000 /month

Achieve more than just Goals !!

Regular portfolio Reviews

Course correct your investments with portfolio health reports.

Accumulate Wealth Faster

Custom Asset allocation

Get the equity and debt proportions right with your risk profile.

Save Tax and Exit loads

With our Tax optimisationTM feature, save a ton when you withdraw.

Our Services

Mutual Investment Solutions Tailored Just for You

Smart Investments for a Secure Future

Calculate SIP Returns

Invested Amount: ₹0

Estimated Returns: ₹0

Total Value: ₹0

Schedule A Free Consultation

Invest in Top Mutual Funds

Comprehensive Insurance Solutions for peace of mind.

Life is unpredictable, but your peace of mind doesn’t have to be. At Master Fin Investments, we provide a wide range of insurance options designed to protect what matters most—your family, your health, and your future. Whether it’s life insurance, health insurance, or other coverage solutions, our offerings are tailored to meet your unique needs.

Our dedicated team helps you navigate the complexities of insurance, ensuring you choose the right plans to safeguard your loved ones and assets. With a commitment to transparency and customer-first service, we make securing your future simple and stress-free.

Car Insurance

Term Plan

Mediclaim

Life Insurance

Contractor Policy

Employee Policy

It's easy to start insurance.

Book Online

Call our Advisor

Master Fin Investments transformed my approach to investing. Their personalized mutual fund advice helped me diversify my portfolio and achieve consistent returns. Highly recommended!

Testimonial

Positive Reviews From Customers

FAQs

Frequently Asked Questions

We offer a range of insurance products, including life insurance, health insurance, and general insurance, to provide comprehensive coverage for your financial needs.

Mutual funds are investment vehicles that pool money from multiple investors to invest in diversified portfolios of stocks, bonds, or other securities. Professional fund managers oversee these investments to achieve growth or income based on the fund’s objective.

Mutual funds offer diversification, professional management, and liquidity. They cater to different risk appetites and financial goals, making them suitable for both novice and experienced investors.

Selecting the right mutual fund depends on your financial goals, risk tolerance, and investment horizon. Our advisors can help you identify funds aligned with your objectives, such as SIPs for long-term goals or equity funds for higher returns.

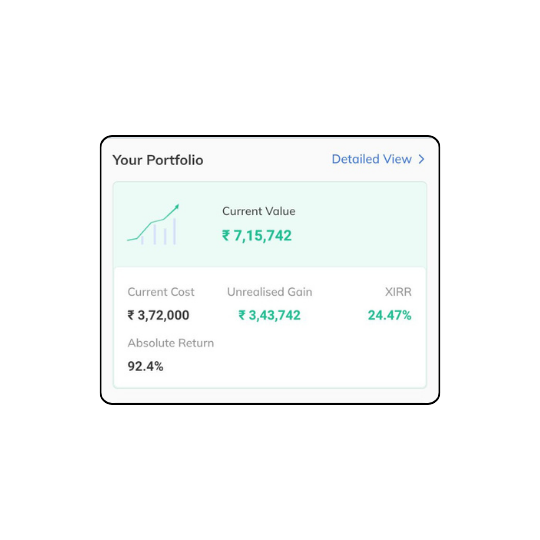

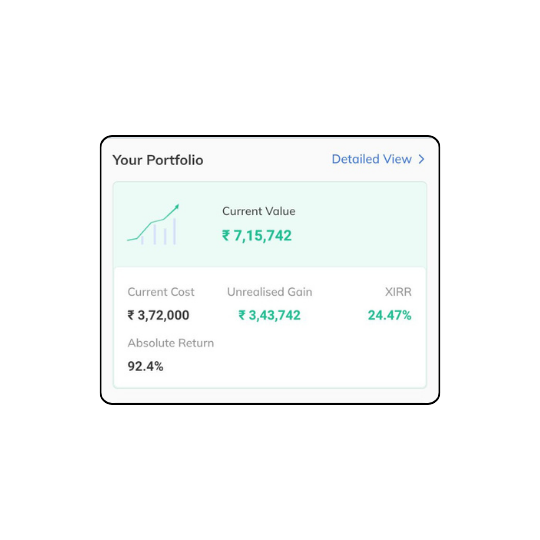

You can track your mutual fund investments through:

- Online Platforms: Use the online portal or mobile app provided by the mutual fund house or your investment advisor. These platforms offer real-time updates on your portfolio.

- Account Statements: Mutual fund companies regularly send account statements to your registered email, detailing your portfolio’s performance.

- Consolidated Account Statements (CAS): You can request a CAS from the registrar (CAMS/Karvy), which consolidates all your mutual fund holdings across different fund houses.

Choosing the right policy depends on your personal needs, family responsibilities, and financial goals. Our experts can help you assess your requirements and recommend policies tailored to your situation.

Learn More

Top Expert Financial Advisor in Ahmedabad

In today’s fast-paced world, sound financial planning is no longer optional—it’s essential. Whether you’re aiming to grow your wealth, save taxes, or secure your family’s future, having a reliable financial advisor in Ahmedabad can make all the difference. With personalized guidance, structured investment strategies, and a deep understanding of market trends, a qualified financial planner helps you navigate your financial journey confidently.

Why You Need a Financial Advisor in Ahmedabad

Ahmedabad is a growing economic hub, with a thriving middle class and a rising number of salaried professionals and entrepreneurs. As incomes rise, so do financial responsibilities and aspirations. A professional financial advisor in Ahmedabad provides you with:

Goal-based investment planning.Risk management and insurance advisory.

Tax-saving investment strategies.

Estate planning and succession advice.

Periodic financial reviews and portfolio rebalancing.

With expert advice tailored to your income, goals, and risk tolerance, you can make smarter decisions and avoid common financial pitfalls.

Mutual Fund SIP Planning

Systematic Investment Plans (SIPs) are one of the most effective ways to build wealth over time. A good financial advisor in Ahmedabad helps you:

- Choose the right mutual fund schemes aligned with your goals

- Decide the ideal SIP amount based on income and expenses

- Set up SIPs for specific objectives like a house purchase or vacation

- Monitor and optimize returns periodically

With market volatility being inevitable, SIPs ensure disciplined investing and rupee cost averaging, making them a safe and efficient option for long-term wealth creation.

Retirement Planning

Many individuals ignore retirement planning until it’s too late. A financial advisor in Ahmedabad helps you plan for a secure and financially independent retirement. Key components include:

- Calculating your retirement corpus based on future expenses

- Recommending a mix of equity and debt investments

- Using instruments like NPS, EPF, and mutual funds effectively

- Reviewing your retirement portfolio annually

Retirement planning is more than just saving money—it’s about building a future where you can enjoy life without financial stress.

Children’s Education Planning

With rising education costs, planning for your child’s education has become critical. A knowledgeable financial advisor in Ahmedabad will help you:

- Estimate future education costs (domestic and abroad)

- Select long-term investment tools like balanced mutual funds or ULIPs

- Set up SIPs or recurring investments from an early stage

- Ensure that your insurance coverage includes education needs in case of unforeseen events

This ensures your child’s future is financially secure, no matter what.

Personal Financial Planning

Comprehensive financial planning involves more than just investments. A full-service financial advisor in Ahmedabad will also assist you with:

- Budgeting and expense tracking

- Emergency fund creation

- Optimal loan and credit card management

- Insurance portfolio assessment (life, health, term)

- Tax planning across salary, business, or rental income

They also educate clients about financial literacy and provide tools to track goals and returns, empowering you to take control of your finances.

How to Choose the Right Financial Advisor in Ahmedabad

Here are a few things to look for when choosing a financial advisor in Ahmedabad:

- AMFI Registration: Ensure they are a certified mutual fund distributor.

- Experience: Prefer advisors with 5+ years of experience and client testimonials.

- Transparent Fee Structure: Choose advisors with clear, fair pricing.

- Technology-Enabled: Look for advisors using tools for goal tracking and portfolio management.

- Holistic Approach: The advisor should cover investments, insurance, tax, and retirement.

Whether you’re an early-stage earner, mid-career professional, or nearing retirement, a financial advisor in Ahmedabad provides tailored advice for every life phase.

Start Planning Your Financial Future Today

The right financial advisor in Ahmedabad will act as a guide, coach, and partner in your financial journey. From SIP planning and mutual funds to retirement savings and child education, expert advice goes a long way in ensuring financial peace of mind.

Don’t leave your future to chance. Consult a professional financial advisor in Ahmedabad and take the first step towards smarter money decisions.

Disclaimer: Mutual fund investments are subject to market risks. Please read all scheme-related documents carefully before investing.

Blog News

Articles From Master Fin Investment

Want Monthly Income from Mutual Funds? Here’s How ₹1 Cr Can Make You Crorepati Twice Over! Discover SWP Magic! 💸

Imagine this: You’ve just retired or sold a property, and…

New NFO Alert: Is UTI Multi Cap Fund the Smartest Mutual Fund Pick of 2025?

UTI Multi Cap Fund NFO – Add “Multi-Vitamins” to Your…