Highest Return Mutual Fund in Last 10 Years: What Every…

Welcome to Master Fin Investments

Invest in Mutual Funds Online

Mutual Funds are a smart way to grow your money. They can help you achieve your financial goals as they have the potential to generate higher-than-inflation returns.

What Are Mutual Funds

Mutual funds are a popular investment option where money from multiple investors is pooled together to create a collective fund. This fund is then managed by a professional fund manager who strategically invests the collected money across a variety of financial assets such as equities (stocks), fixed-income securities (bonds or debts), gold, and other market-linked instruments. The primary objective of this pooled investment is to generate returns for the investors.

Mutual funds are designed to cater to a wide range of financial goals and risk appetites, offering investors a diversified and professionally managed portfolio without requiring them to manage individual assets directly.

This makes mutual funds an accessible and efficient way for individuals to participate in the financial markets while benefiting from professional expertise and diversification

Schedule A Free Consultation

How to Start Your Investing Journey with Master Fin Investments?

At Master Fin Investments, we follow 3 easy steps to make mutual fund investments simple, convenient, and quick:

Sign up with us & Complete your KYC

Search & Select Mutual Funds

Invest One Time or SIP with as low as ₹100

Ways to Invest in Mutual Funds

SIP (Systematic Investment Plan)

SIP allows you to invest a fixed sum at regular intervals. SIP is one of the most recommended ways to invest in mutual fund schemes as it is convenient. It also helps you average out the cost at which you buy the units of these funds.

Lumpsum Investment

When you make a one-time investment, it is called lumpsum. Lumpsum investments are generally done when people have got a big sum of money like bonuses or payments from a sale of an asset.

Learn Mutual Funds Benefits

Benefits of Investing in Mutual Funds

Investing in mutual funds offers several advantages that make them an appealing option for both novice and experienced investors. Here are the key benefits:

Professional Management

Mutual funds are managed by experienced fund managers who make investment decisions based on thorough research and market analysis. This professional expertise ensures that your money is invested strategically to maximize returns.

Diversification of Investments

Mutual funds invest in a variety of asset classes, including equities, bonds, and other securities. This diversification reduces the impact of poor performance from a single asset, spreading risk across a broader portfolio.

Accessibility and Affordability

You don’t need a large sum of money to start investing in mutual funds. With Systematic Investment Plans (SIPs), you can begin investing with as little as ₹500 or ₹1,000 per month, making it an accessible option for all income groups.

Tax Benefits And Flexibility

Certain mutual funds, like Equity-Linked Savings Schemes (ELSS), provide tax benefits under Section 80C of the Income Tax Act, allowing you to save taxes while growing your wealth.

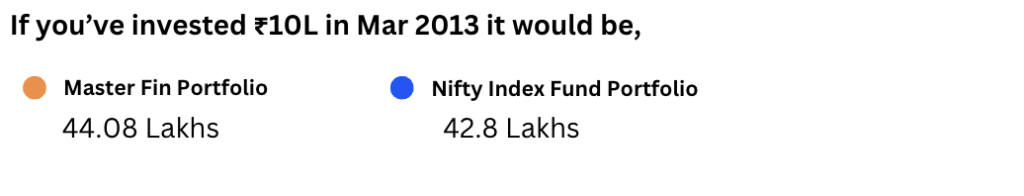

Staying invested in Master Fin Investments Portfolio resulted in 2.5% higher ROI compared to Nifty Index Funds.

Types of Mutual Funds Based on Asset Class

Equity Mutual Funds

Equity funds invest a majority of their assets in stocks. These funds are classified into different categories based on the market cap of the stocks they invest in.

Large Cap Equity Funds

These funds invest at least 80% of their assets in the top 100 companies by market capitalization.

Mid Cap Equity Funds

These funds invest at least 65% of their assets in the next 150 (101st to 250th) companies ranked by market capitalization.

Small Cap Equity Funds

Such funds invest at least 65% of their assets in companies ranked 251 and above by market capitalization.

Multi-Cap Equity Funds

These funds invest at least 25% of their assets in each of the large, mid, and small-cap stocks.

Debt Mutual Funds

Debt funds generate returns by lending money to corporates and the government by buying their debt papers. These funds are classified into different categories based on their lending period and credit quality of the papers.

Money Market Funds

These funds generate returns by lending to companies or governments for up to 1 year.

Corporate Bond Funds

These funds earn returns by lending mostly (at least 80%) to companies with the highest-rated debt papers.

Overnight Funds

These funds earn their returns by lending to companies or governments for one business day.

Liquid Funds

These funds generate their returns by lending to companies or governments for up to 91 days.

Hybrid Funds

Hybrid funds invest in a mix of asset classes, including equity, debt, or gold. There are multiple categories of hybrid funds based on how much they allocate across different asset classes.

Aggressive Funds

These funds have to invest at least 65% of their assets in equities while it can't exceed 80%. The rest goes into debt.

Multi Asset Allocations

These are hybrid funds that invest at least 10% of the total of their assets across at least three asset classes, such as equity, debt, gold, etc.

Dynamic Asset Funds

Also known as Balanced Advantage Funds, these funds can go up to 0-100% in equities or debt based on predefined asset allocation models they follow.

Arbitrage Funds

These funds generate returns by using opportunities of price differences of securities in different markets.

Get Top Amcs

Invest in Top Funds From 40+ AMCs

FAQs

Frequently Asked Questions

Important Questions About Investing in Mutual Funds

A mutual fund is a trust that pools investors' money. Investors are allotted units of the funds as per their share of investment in the pool of assets. This money is then invested across various types of mutual funds like equity, debt, and other securities by the fund manager appointed by the asset management company.

The objective of the fund manager is to generate good returns. The gains or losses generated by the fund are distributed among the unitholders (investors) in the proportion of the share of investment.

There is no straight answer to this question. Different funds have different risk-return profiles. You need to choose a fund based on your risk-taking capabilities and the time horizon you have in mind for the investment. So, you need to balance your risk tolerance and the risk of the fund you plan to invest in. For example, if you are willing to take high risk but your investment horizon is less than 3 years, you shouldn't invest fully in equity funds.

You may consider investing in a mix of equity and debt with more exposure to debt funds. Therefore, you need to choose the best mutual fund based on your risk appetite and time horizon.

On withdrawal, if your redemption value is higher than the purchase price of a mutual fund, the same will be classified as capital gains. The gains from equity (above a threshold limit) and debt funds are taxable. The gains are classified as short-term capital gains (STCG) or long-term capital gains, depending on the holding period.

In the case of equity funds, if you sell your investments before one year, gains will be classified as STCG otherwise, LTCG. In the case of debt mutual funds, if you sell your funds after 3 years, the gains will be classified as LTCG. However, gains on holdings sold before 3 years will be classified as STCG. You can read in detail about capital gains tax on mutual fund returns here

There are different methods of calculating the returns of a mutual fund, each suited to different types of investments and time frames. Let's understand these methods:

Absolute Return: This is the simplest method. It is the percentage change in the value of your investment over a specific period. It does not consider the time over which this change occurred. Example: If you invested when the NAV was ₹10 and sold when it was ₹12, your absolute return would be 20%

Compound Annual Growth Rate (CAGR): This is the annualized rate of growth of an investment over a specified period, also considering the time taken. For example, if you invested when the NAV was ₹10 and sold when the NAV was ₹20 after 1.5 years, your CAGR would be 15.43% = (12/10)1/1.5

Besides Absolute Return and CAGR, in reality, investments in mutual funds happen in multiple installments over some time. The above two methods do not account for such a scenario. To solve this, we have two more methods:

Time Weighted Rate of Return (TWRR): This method breaks down the investment period into multiple sub-periods based on when cash inflows and outflows happened. Then calculates the absolute return for each sub-period and aggregates them together for the total investment period return. Note that the size of the cash flow is ignored in this method.

Extended Internal Rate of Return (XIRR): This method accounts for both the timing and size of each cash flow in your investment over time. It is the most comprehensive measure of the annual rate of return on an investment. It can also easily support other cash flows like dividends, interest payments, etc in the calculation to give a complete picture of the total return.

Exit Load is a small fee that some AMCs (Asset Management Companies) charge the investor if they choose to withdraw (or redeem) the investment before a specific time period.

The purpose of exit load is to discourage investors from withdrawing investments before a certain time frame. Exit load structure varies from fund to fund. It is usually a percentage of the amount being redeemed/sold. For example, if the exit load is 1% and an investor redeems ₹10,000 worth of units, the fund will deduct ₹100 as the exit load.

Yes, you can invest in mutual funds under your minor child’s name in India. Investing in your child’s name gives them a head start on wealth accumulation and the benefit of compounding and the investment starts much sooner.

To get started, you will be required to set up a Mutual Fund account in your child’s name. This account must be operated by the parent/guardian.

You will need your PAN card, Aadhaar, and KYC verified. For your child - you will be required to show the birth certificate/passport or verify age and relationship with the guardian. The investments can be made as lump sums or through a Systematic Investment Plan (SIP).

Additional guidelines:

- Only the guardian can operate the minor’s account until the child turns 18.

- Upon turning 18, the minor must complete KYC requirements, and the account will be transferred to their name.

- Earnings are clubbed with the guardian’s income unless the minor earns separately through other investments.

- Certain investment options like SIP pause and overdraft against investments may not be available in minor accounts.

A New Fund Offering (NFO) is like the grand opening of a mutual fund. When an asset management company (AMC) launches a new mutual fund, it offers it to the public at a fixed price, typically ₹10 per unit. This process allows the AMC to raise money to start investing according to the fund's strategy. Think of it as similar to a company’s IPO (Initial Public Offering), where shares are introduced to the stock market for the first time. Investors often consider NFOs if the fund's theme or strategy aligns with their goals. For example, a new fund might focus on environmental sustainability, global markets, or a niche sector. However, it’s essential to research the fund’s objectives and potential before investing.

ETFs (Exchange-Traded Funds) and mutual funds might seem similar because both pool money from investors to create a diversified portfolio. However, they have some key differences. ETFs are traded on stock exchanges, just like individual stocks. You can buy or sell them at any time during market hours at a price that fluctuates throughout the day. On the other hand, mutual funds are bought or sold directly through the fund company, and the price is based on the Net Asset Value (NAV), which is calculated at the end of the day.

Another difference lies in management and cost. ETFs are usually passively managed, meaning they aim to match the performance of an index like the Nifty 50 or S&P 500. Mutual funds can be actively managed, where fund managers decide which stocks to buy or sell to outperform the market, but this often makes mutual funds more expensive. Finally, ETFs are more tax-efficient because of how they are structured, while mutual funds may trigger more taxes due to frequent buying and selling of securities within the fund.

Blog & News

Articles From Master Fin Investments

Want Monthly Income from Mutual Funds? Here’s How ₹1 Cr Can Make You Crorepati Twice Over! Discover SWP Magic! 💸

Imagine this: You’ve just retired or sold a property, and…

New NFO Alert: Is UTI Multi Cap Fund the Smartest Mutual Fund Pick of 2025?

UTI Multi Cap Fund NFO – Add “Multi-Vitamins” to Your…