Introduction to Mutual Fund

What are Mutual Funds?

Mutual funds are professionally managed investment schemes that pool money from multiple investors and invest it across a diversified portfolio of equities, debt instruments, money market securities, or a combination of these. Mutual funds allow individuals to invest without needing expertise in financial markets.

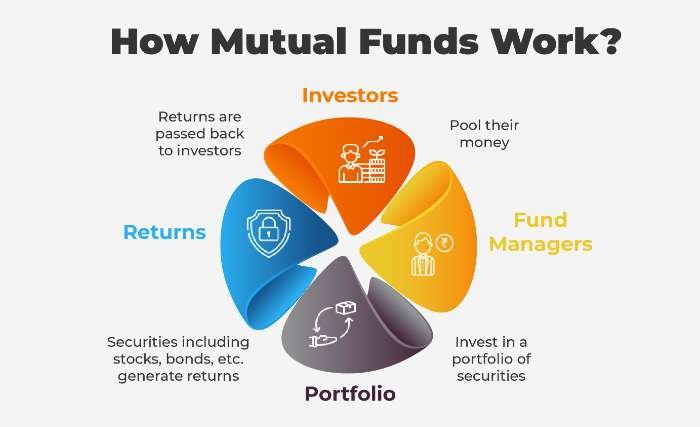

How Do Mutual Fund Investment Work?

Investors contribute money to a mutual fund, and the fund manager allocates this collective pool into various securities according to the fund’s stated objectives. Returns generated (gains/losses) are distributed among investors proportionally. Each investor holds units representing their share of ownership in the fund.

What is SIP & Lumpsum?

Systematic Investment Plan (SIP):

A SIP allows investors to invest a fixed amount regularly (weekly, monthly, quarterly) into a mutual fund scheme. SIPs promote disciplined investing, benefit from rupee cost averaging, and harness the power of compounding over the long term. SIPs are ideal for investors who prefer gradual investment aligned with their income flow.

Lumpsum Investment:

In a lumpsum investment, the investor deploys a significant amount into a mutual fund at once. Lumpsum investments are suitable when investors have surplus cash and want to take advantage of market conditions immediately. While it offers instant market exposure, it is more sensitive to market timing.

Both SIP and lumpsum investments offer different benefits and can be strategically used based on an investor’s financial goals, risk tolerance, and market outlook.

Why Invest in Mutual Funds?

Mutual funds offer a hassle-free, efficient, and reliable investment option for individuals looking to build wealth without actively managing their portfolios. They provide instant diversification, reducing the risk exposure associated with investing in a single asset. Professional fund managers bring their expertise in analyzing markets and selecting quality securities, saving investors time and effort. Furthermore, mutual funds come in a variety of types and structures, allowing investors to choose schemes that align with their risk tolerance, investment horizon, and financial goals. This flexibility, combined with transparency, regulation by SEBI, and liquidity, makes mutual funds one of the most accessible and attractive investment options for both beginners and experienced investors.

Mutual fund investments are ideal for investors seeking a structured, hassle-free approach to growing their wealth.

Table of Contents

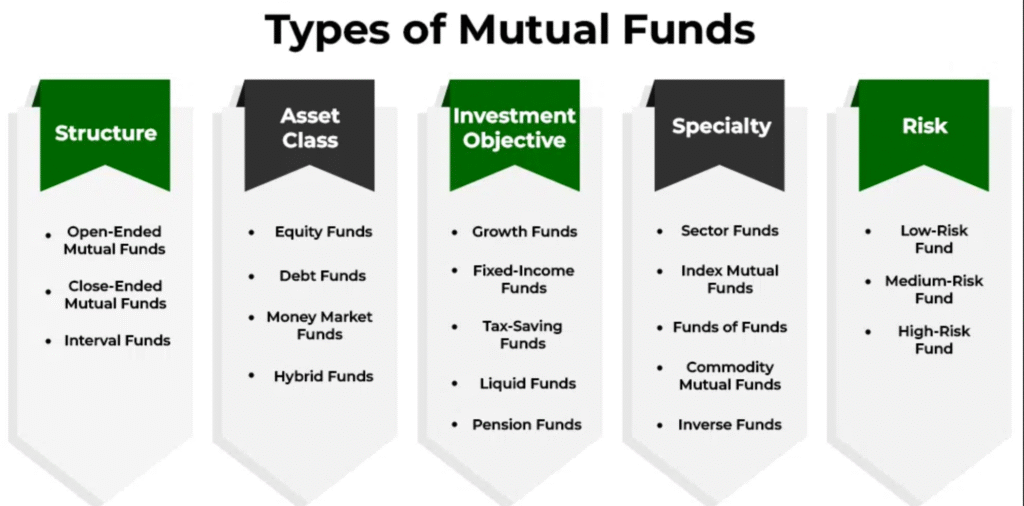

Types of Mutual Fund Schemes

Mutual funds can be classified in several ways depending on their structure, management style, investment objective, and underlying assets.

Based on Organisation Structure:

- Open-Ended Funds: Investors can buy or redeem units at any time.

- Close-Ended Funds: Investors can subscribe only during the initial offer period. Redemption is allowed after maturity.

- Interval Funds: A mix of open and close-ended funds, allowing purchase/redemption at specified intervals.

Based on Management of Portfolio:

- Actively Managed Funds: Fund managers make active investment decisions aiming to outperform the market.

- Passively Managed Funds: Funds mirror a market index (e.g., Nifty 50) and aim to replicate returns.

Based on Investment Objective:

- Growth Funds: Focus on capital appreciation over time.

- Income Funds: Aim to provide regular income through fixed-income instruments.

- Liquid Funds: Focus on short-term investments, offering high liquidity.

Based on Underlying Portfolio:

- Equity Funds: Invest in stocks of listed companies.

- Debt Funds: Invest in government securities, corporate bonds.

- Hybrid Funds: Combine equity and debt in varied proportions.

- Money Market Funds: Invest in short-term debt instruments.

- Multi-Asset Funds: Invest across multiple asset classes like equity, debt, gold, etc.

Thematic / Solution-Oriented Funds:

- Tax Saving Funds (ELSS): Eligible for tax deductions under Section 80C.

- Retirement Benefit Funds: Designed for retirement planning.

- Child Welfare Funds: Focused on child education/marriage goals.

- Arbitrage Funds: Exploit price differences between cash and derivatives markets.

Other Types:

- Exchange Traded Funds (ETFs): Tradeable like stocks but structured like mutual funds.

- Overseas Mutual Funds: Invest in global markets.

- Fund of Funds (FoFs): Invest in other mutual fund schemes.

To Know More Get Free Consultation For Best Mutual Funds to invest in India

Best Performing Funds Across Categories

| Category | Top Performing Funds |

|---|---|

| Equity Funds | 1.Parag Parikh Flexi Cap Fund 2.Mirae Asset Large Cap Fund 3.SBI Small Cap Fund |

| Debt Funds | 1.HDFC Corporate Bond Fund. 2.Axis Short Term Fund. 3.ICICI Prudential Corporate Bond Fund |

| Hybrid Funds | 1.HDFC Hybrid Equity Fund 2.ICICI Prudential Balanced 3.Advantage Fund, SBI Equity Hybrid Fund |

| Thematic Funds | Mirae Asset Tax Saver Fund, Axis Retirement Savings Fund, UTI Child Care Fund |

| ETFs | Nippon India ETF Nifty BeES, ICICI Prudential Nifty Next 50 ETF, SBI ETF Sensex |

| Overseas Funds | Motilal Oswal Nasdaq 100 Fund, Franklin India Feeder US Opportunities Fund, PGIM India Global Equity Fund |

| Fund of Funds | Edelweiss US Technology Equity Fund of Fund, Motilal Oswal Asset Allocation Passive FoF, HDFC Asset Allocator Fund |

What is Total Expense Ratio (TER)?

Under SEBI (Mutual Funds) Regulations, 1996, mutual funds are permitted to charge operational expenses such as management fees, administrative charges, and marketing expenses under a collective charge called Total Expense Ratio (TER).

Key Facts About TER:

- TER is calculated as a percentage of a fund’s average Net Asset Value (NAV).

- The lower the TER, the higher the potential returns for investors.

Regulatory Limits Effective from April 1, 2020:

| AUM Slab | Max TER (Equity) | Max TER (Debt) |

| First Rs.500 crores | 2.25% | 2.00% |

| Next Rs.250 crores | 2.00% | 1.75% |

| Next Rs.1,250 crores | 1.75% | 1.50% |

| Next Rs.3,000 crores | 1.60% | 1.35% |

| Next Rs.5,000 crores | 1.50% | 1.25% |

| Above Rs.50,000 crores | 1.05% | 0.80% |

Funds sourcing investors beyond India’s top 30 cities can charge 30 bps more.

Importance:

A lower TER leads to better compounding of returns over time, making it a critical selection factor when choosing mutual fund.

Advantages of Investing in Mutual Funds

Investing in mutual funds offers several distinct advantages, making them an attractive proposition for a wide range of investors:

- Professional Management: Access to expert fund managers who continuously research, analyze, and manage investments.

- Diversification: By investing across sectors, geographies, and asset classes, mutual funds help mitigate risk.

- Affordability: Investors can start with small amounts through SIPs (Systematic Investment Plans), making it accessible to all income groups.

- Liquidity: Open-ended mutual funds provide the flexibility to redeem investments anytime, offering high liquidity.

- Transparency: Regular disclosures of portfolio holdings, NAV, and expense ratios ensure complete transparency.

- Regulation and Safety: Mutual funds are regulated by SEBI, ensuring investor protection and ethical practices.

- Tax Benefits: Certain funds like ELSS (Equity Linked Savings Scheme) offer tax deductions under Section 80C of the Income Tax Act.

By investing in mutual funds, individuals can grow their wealth while managing risk effectively through a trusted, regulated, and flexible investment vehicle.

Risk Factors in Mutual Fund Investments

Standard Risks:

- Market risks due to fluctuations in stock or bond markets.

Specific Risks:

- Price Risk: Volatility in asset prices.

- Liquidity Risk: Difficulty in selling investments without significant loss.

- Interest Rate Risk: Impact of interest rate changes on bond prices.

- Credit Risk: Risk of default by bond issuers.

- Re-investment Risk: Risk of reinvesting returns at lower rates.

History of Mutual Funds in India

Mutual funds in India began in 1963 with the establishment of UTI. The 1980s saw the entry of public sector mutual fund. Liberalization in the 1990s introduced private players, leading to innovation and competition. The Mutual Funds industry today is vibrant and rapidly growing with robust regulatory oversight. (Reference: AMFI History of Mutual Funds)

Tax Regime for Mutual Fund Investors in India (FY 2024-25)

Key Tax Highlights:

- Equity mutual fund taxed at 15% (STCG) and 10% (LTCG after Rs.1,25,000 gain).

- Debt mutual fund taxed at individual tax slabs for STCG and 20% LTCG.

- Dividend income taxed as per applicable slab.

| Fund Type | Short-Term Tax | Long-Term Tax |

| Equity Funds | 15% | 10% beyond Rs.1,25,000 |

| Specified Mutual Funds | Taxed as per slab | NA |

| Other Mutual Funds | Taxed as per slab | 20% with indexation |

TDS Applicability:

TDS applicable on dividends exceeding Rs.5,000 at 10% rate.

Important Note: Surcharge and Health/Education Cess apply additionally.

Conclusion

Mutual funds are an excellent choice for both novice and seasoned investors seeking professional wealth management. Understanding mutual fund types, costs, risks, and tax implications is crucial to making informed decisions.

Ready to start your mutual fund investment journey?

Trust the expertise of Master Fin Investments — an AMFI-registered mutual fund distributor dedicated to helping you achieve your financial goals.

For more information, visit AMFI India.

Disclaimer: Mutual Fund investments are subject to market risks. Please read all scheme-related documents carefully before investing.